Lots of people go to the beach but very few get in the water. 3,000 students go to the football game to watch 20 of their peers play. And we go to a conference to meet people and...

Blog

Wage Subsidies Available

Workforce Australia advises that financial support up to a maximum of $10,000 may be available to businesses that hire new staff. Wage subsidies may be available to businesses that hire eligible individuals into ongoing jobs. Wage subsidies can be up to a maximum of $10,000.

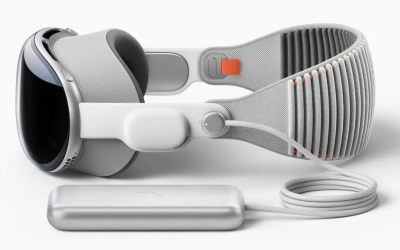

‘New era’: Apple dives into ‘spatial computing’ with extended reality headset

Get used to the term ‘spatial computing’ — Apple is going to make sure you start hearing it a lot, as it attempts to overtake Meta in the headset race.

Overnight the tech giant unveiled its long-awaited augmented reality headset — the Apple Vision Pro — as the centrepiece of its annual Worldwide Developers Conference.

Significant Changes Coming to Modern Awards Starting May 1st, 2023

The new shutdown clauses in modern awards will come into effect from 1st May 2023.

The most significant change for many employers will be removing the ability for an employer to direct an employee to take a period of “leave without pay” if that employee does not have enough annual leave accrued to cover the shutdown period.

Some modern awards currently have this provision, although most do not.

Fixed-rate Housing Loans: Monetary Policy Transmission and Financial Stability Risks

The RBA has posted an informative article highlighting the effects of the COVID-19 pandemic on fixed-rate housing loans. It found that during COVID, the value of fixed-rate housing loans increased substantially, which has delayed the effect of the higher cash rate on borrowers’ cash flows. A key issue for the economic outlook, and by implication financial stability, relates to the ability of borrowers with fixed-rate loans to adjust to substantially higher borrowing costs when their fixed-rate mortgages expire. Borrowers with expiring fixed-rate loans face large increases in their repayments. Fixed-rate loans have riskier characteristics than variable-rate loans.

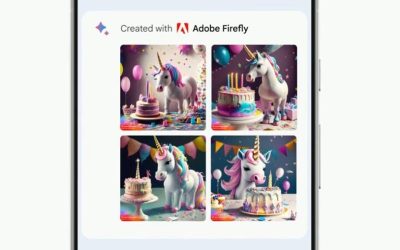

Is watermarking AI-generated images going to be enough to identify fakes and deep-fakes?

This is what Google is suggesting they will be doing to help us identify what they call 'synthetic' images. We're not really in a place to know if this will be the best solution....